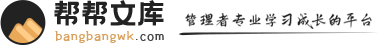

全额高管层年终奖个税测算表年薪标准月薪标准工资月度应发工资(A)统筹及公积金(B)月度扣个人所得税基数(C=A-B)月度个人所得税(a)月度实得工资(D=C-a)年度结余工资(E)年度结余工资扣税基数(E/12)年度结余工资个人所得税(b)年度个人所得税总计(c=a*12+b)个人年度实得工资(扣税,扣统筹)(F=D*12+E-b))1200000100000100000.002772.0097228.0028672.6068555.400.000.000.00344071.20822664.80120000010000041272.002772.0038500.007745.0030755.00704736.0058728.00241152.60334092.6832643.40120000010000055000.002772.0052228.0011863.4040364.60540000.0045000.00159245.00301605.8865130.20120000010000061272.002772.0058500.0013745.0044755.00464736.0038728.00136665.80301605.8865130.20120000010000080000.002772.0077228.0020299.8056928.20240000.0020000.0058995.00302592.6864143.40级数含税级距税率(%)速算扣除数1不超过1,500元的302超过1,500元至4,500元的部分101053超过4,500元至9,000元的部分205554超过9,000元至35,000元的部分2510055超过35,000元至55,000元的部分302,7556超过55,000元至80,000元的部分355,5057超过80,000元的部分4513.505年终奖个人所得税计算方式:发放年终奖的当月工资高于3500元时,年终