帮帮文库

>

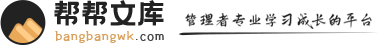

工资年终奖调节试算表(模板)

-

6.9G

工作通用报告

-

9万套

PPT通用模板

-

23种

精品销售话术

-

1790套

KPI表格

-

1168份

资料合集

-

13类

工作领域